Please Select:-

(2) I have not yet upgraded or I am unsure – Please read on below.

Making Tax Digital Q&A – IMPORTANT UPDATE

Due to a change in UK tax legislation, by April 2019, customers will be UNABLE to submit their VAT returns manually via the HMRC gateway and must do so directly via their accounting software. Sage 50 Accounts users need not worry, your software will receive updates over the internet automatically from Sage directly so that your software remains compliant. Sage 200 customers however may need to take action accordingly. The only version of Sage 200 that is currently compliant with the new HMRC digital service is the Spring 2018 release. Subsequent releases between April 2018 and April 2019 will also be compliant, but older versions will not be. This means customers need to upgrade to become compliant.

Century Software highly recommend that all Sage 200 clients upgrade to the latest Sage 200 MTD compliant version by the end of March 2019, avoiding having to purchase an additional module. However, Sage understand that not all customers will be in a position to upgrade before April 2019, therefore have created a new MTD Submission module to provide customers on previous Sage 200 versions the ability to comply with the mandate without upgrading in the short term.

2. Which customers will this affect?

All customers, across all variants of Sage 200 excluding Spring 2018. If a customer is on v2010 and below, including legacy Line 100 versions, they cannot buy the module, you must upgrade to the latest version of Sage 200c.

Sage 50 Accounts users will receive automatic updates to their software over the internet (this is the default setting, however you may have switched auto updates off in the settings) and are not effected.

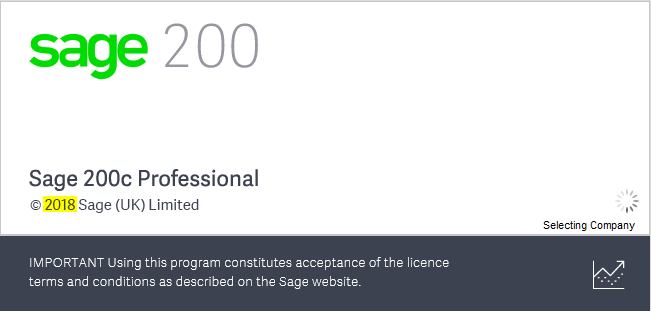

2a. How can I check that my current version is the 2018 Spring release?

The easiest way to tell is to look at the loading screen that appears when you first launch Sage 200. If you are using an MTD compliant version, you will see that the copyright year is 2018 as below. If yours is showing 2017, 2016, 2015 or below, you are using an older Sage 200 version and will either need to upgrade or purchase the MTD module. However as noted above in point 2 if you use Sage 200 Version 2010 or below you cannot buy the MTD module.

3. How much will it cost if I don’t upgrade and purchase the MTD module?

The price for the module varies by product version and the time at which the module is purchased. The below explains in more detail. This pricing strategy is being used to encourage customers to take up the module early, allowing them to start submitting to HMRC before the mandate is live. The module will be sold to customers on an annual subscription. If at the point of renewal, Sage see that they haven’t upgraded to a compatible version of 200c, the subscription will automatically renew.

|

3a. I received your email regarding MTD but the pricing was different to the above. Why has this changed?

Sage UK Ltd communicated to us on 12th July 2018 that they had listened to business partner’s concerns that the charges were too high and have extended the first tier pricing until September 28th 2018. After which time the module will become more expensive.

4. Will the price of the submission module increase each year?

Yes. The older the version a customer is on, and the longer they stay on it, the more expensive the module will become. Cost increments are yet to be confirmed but will be available at the point of renewal, should the customer not upgrade.

5. What if a customer chooses not to buy the module from Sage?

The customer has 2 options – upgrade to the latest version or buy the submission module. If neither option is availed of, Sage will assume that a customer has chosen an alternative unsupported solution from a third party. In this instance, they will incur an additional £1,800 MTD services charge per year, until the latest software version is adopted. This charge will be applied at the point of renewal (from April 2019 onward) and is in line with existing agreements.

6. What is the MTD services charge?

This is an annual fee, applicable to all customers who do not upgrade or buy the submission module but still require support from Sage. This charge will be in line with Sage’s product life-cycle strategy, therefore no technical support will be given to products where support has ceased.

7. What does the MTD Services charge cover?

The older the version of Sage 200, the more expensive it is to maintain. Sage understands that a number of customers are not in a position to upgrade to the latest version at this moment in time, therefore have invested heavily in retrofitting the MTD module to older versions (up to v2011). If a customer uses Sage 200 to submit VAT, Sage assumes they will need MTD Services regardless of what tool they use to do their submissions – whether that is the Sage MTD Submission module or a third party, unsupported solution.The charge also enables Sage to mitigate additional costs that they may incur for customers using unsupported solutions to complete their VAT submissions via Sage 200. Sage cannot guarantee that a third-party solution will function without implications to the core product functionality, therefore must ensure they have sufficient cover to enable them to resolve any technical and/or support issues as a result of a third-party integration impacting functionality. Furthermore, the services charge enables Sage to maintain support and compliance for future MTD requirements from HMRC.

8. Are there exemptions from the MTD services charge?

Yes, for example those under the VAT threshold. There may be other exemptions too – if a customer feels they fall under this category they must notify Sage prior to renewal to ensure the charge is not added.

9. Will there be a renewal cost associated with this module from year two onwards if the customer has still not upgraded. If so, will this be at the usual 10%?

Yes, the module comes on an annual subscription and the price will increase each year. The exact % increase is still TBD but customers will be made aware of the price change prior to renewal.

Please be aware:

Due to the high number of customer upgrades required, requests will be processed on a first come – first served basis.

Please contact us to discuss how you wish to proceed.

Best Regards,

Century Software Ltd